How Can You Determine if There Are Enough Finished Goods in Inventory to Fulfill a Sales Order?

Nature of Inventory

Inventory represents finished and unfinished goods which have not even so been sold by a visitor.

Learning Objectives

Explain the purpose of inventory and how a company controls and reports it

Key Takeaways

Fundamental Points

- Inventories are maintained because time lags in moving appurtenances to customers could put sales at risk.

- Inventories are maintained as buffers to see uncertainties in demand, supply and movements of goods.

- There are iv stages of inventory: raw material, work in progress, finished goods, and goods for resale.

- Raw materials – materials and components scheduled for use in making a production. Work in process, WIP – materials and components that have began their transformation to finished goods. Finished appurtenances – goods ready for sale to customers. Appurtenances for resale – returned goods that are salable.

- When a merchant buys appurtenances from inventory, the value of the inventory account is reduced by the price of goods sold. For commodity items that 1 cannot track individually, accountants must choose a method that fits the nature of the sale.

- FIFO (first in-outset out) regards the first unit that arrived in inventory as the first sold. LIFO (last in-first out) considers the last unit arriving in inventory as the first sold. Using LIFO accounting for inventory a company reports lower net income and book value, resulting in lower taxation.

Key Terms

- inventory: A detailed list of all of the items on manus.

- supply chain: A system of organizations, people, technology, activities, information and resources involved in moving a production or service from supplier to customer.

- raw material: A material in its unprocessed, natural country considered usable for manufacture.

Definition of Inventory

Inventory represents finished and unfinished goods which take not yet been sold past a company.. Inventories are maintained as buffers to come across uncertainties in demand, supply, and movements of goods. These holdings are recorded in an bookkeeping organization.

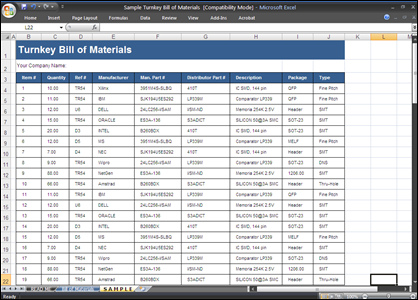

Inventory Template: Case of inventory template.

Housing inventory growth in Phoenix: At that place was an interesting annotate on the housing chimera web log list "bachelor inventory", otherwise known as the number of houses currently for sale, in Phoenix. It listed the available inventory on a daily basis from vii/twenty/2006 to five/9/2006 (up to the twenty-four hours it was posted! )Phoenix is one of the "hot" markets of the housing chimera, only certainly isn't the pinnacle of the listing. Inventory run ups similar this are existence seen nation wide, and are leading to price reductions (if the seller is smart) and long waits to sell every bit bubble flippers all try to greenbacks out at once.

Basic Inventory Bookkeeping

An organization's inventory counts equally a current asset on an organization's residue sheet because the organization can, in principle, turn it into cash by selling it. However, information technology ties up coin that could serve for other purposes and requires additional expense for its protection. Inventory may besides cause significant tax expenses, depending on particular countries' laws regarding depreciation of inventory, as in the case of Thor Power Tool Company 5. Commissioner.

Inventory Systems

In that location are 2 principal systems for determining inventory quantities on hand: periodic and perpetual organisation.

The Periodic Organisation

This organization requires a physical count of goods on mitt at the terminate of a period. A cost basis (i.due east., FIFO, LIFO) is then applied to derive an inventory value. Because it is unproblematic and requires records and adjustments more often than not at the end of a period, information technology is widely used. It does lack some of the planning and command benefits of the perpetual system.

The Perpetual System

The perpetual system requires continuous recording of receipt and disbursement for every detail of inventory. Nigh large manufacturing and merchandising companies apply this system to ensure adequate supplies are on paw for production or sale, and to minimize plush machine shut-downs and customer complaints.

Inventory Costing

Inventory cost includes all expenditures relating to inventory acquisition, preparation, and readiness for auction, minus purchase discounts.

Rationale for Keeping Inventory:

- Time – The time lags present in the supply chain, from supplier to user at every phase, requires that y'all maintain certain amounts of inventory to use in this lead fourth dimension. Even so, in practise, inventory is to be maintained for consumption during 'variations in atomic number 82 time'. Pb time itself can be addressed by ordering that many days in advance.

- Incertitude – Inventories are maintained as buffers to meet uncertainties in need, supply and movements of goods.

- Economies of calibration – Ideal condition of "one unit at a time at a identify where a user needs it, when he needs it" principle tends to incur lots of costs in terms of logistics. So bulk buying, movement and storing brings in economies of calibration, thus inventory.

Stages of Inventory:

- Raw materials – materials and components scheduled for use in making a production.

- Work in procedure, WIP – materials and components that take began their transformation to finished goods.

- Finished goods – goods ready for sale to customers.

- Goods for resale – returned goods that are salable.

Categories of Appurtenances Included in Inventory

Most manufacturing organizations commonly divide their "goods for sale" inventory into raw materials, work in process, and finished goods.

Learning Objectives

Distinguish between the raw materials, work in procedure, finished appurtenances and goods for resale

Key Takeaways

Central Points

- Raw materials – Materials and components scheduled for use in making a product.

- Work in process /progress (WIP) – Materials and components that have began their transformation to finished goods.

- Finished goods – Appurtenances ready for auction to customers.

- Goods for resale – Returned goods that are salable.

- Distressed inventory is inventory for which the potential to be sold at a normal toll has passed or volition soon pass.

- Inventory credit refers to the utilise of stock, or inventory, as collateral to enhance finance.

Primal Terms

- work in progress: A portion of inventory that represents appurtenances which are no longer salable equally raw materials, but non notwithstanding salable as finished goods.

- Piece of work in procedure: a visitor's partially finished goods waiting for completion and eventual sale or the value of these items

- Finished goods: Goods that are completed, from a manufacturing standpoint, just not notwithstanding sold or distributed to the end-user.

- finished goods inventory: the amount of completed products non yet sold or distributed to the end-user

- raw materials: A raw material is the basic material from which a product is manufactured or made.

Categories of Goods

While the reasons for holding stock were covered earlier, most manufacturing organizations commonly carve up their "goods for auction" inventory into several categories:

- Raw materials – Materials and components scheduled for use in making a product.

- Piece of work in process or work in progress (WIP) – Materials and components that have began their transformation to finished goods.

- Finished goods – Appurtenances ready for sale to customers.

- Goods for resale – Returned goods that are salable.

Raw Materials

A raw material is the bones cloth from which a product is manufactured or made. For instance, the term is used to denote material that came from nature and is in an unprocessed or minimally processed state. Latex, iron ore, logs, crude oil, and table salt water are examples of raw materials.

Work in Process (WIP)

WIP, or in-process inventory, includes unfinished items for products in a product process. These items are non yet completed, and are but existence fabricated, waiting in a queue for further processing, or in a buffer storage. The term is used in production and supply concatenation management.

Optimal production direction aims to minimize work in process. Work in process requires storage infinite, represents leap majuscule non available for investment, and carries an inherent gamble of earlier expiration of the shelf life of the products. A queue leading to a production step shows that the step is well buffered for shortage in supplies from preceding steps, just may also indicate insufficient chapters to process the output from these preceding steps.

Finished Goods

Appurtenances that are completed (manufactured) but not yet sold or distributed to the end-user.

Appurtenances for resale

Returned appurtenances that are salable. This is not always included in the "goods for sale" inventory; that depends on the preference of the company.

Example

A canned food manufacturer's materials inventory includes the ingredients needed to grade the foods to be canned, empty cans and their lids (or coils of steel or aluminum for constructing those components), labels, and anything else (solder, glue, etc.) that will grade role of a finished can. The business firm'due south work in process includes those materials from the time of release to the work floor until they become complete and ready for auction to wholesale or retail customers. This may be vats of prepared nutrient, filled cans not yet labeled, or sub-assemblies of food components. It may too include finished cans that are non notwithstanding packaged into cartons or pallets. The manufacturer's finished adept inventory consists of all the filled and labeled cans of nutrient in its warehouse that it has manufactured and wishes to sell to food distributors (wholesalers), to grocery stores (retailers), and even perhaps to consumers through arrangements like factory stores and outlet centers.

Components of Inventory Price

The cost of goods produced in the concern should include all costs of production: parts, labor, and overhead.

Learning Objectives

Place the components used to summate the toll of goods sold

Key Takeaways

Key Points

- Labor costs include direct labor and indirect labor. Direct labor costs are the wages paid to those employees who spend all their time working directly on the product being manufactured. Indirect labor costs are the wages paid to other factory employees involved in production.

- Overhead costs (costs incurred at the establish or organization level) are ofttimes allocated to sets of produced goods based on the ratio of labor hours or costs or the ratio of materials used for producing the set of goods.

- Most businesses make more than i of a detail particular. Thus, costs are incurred for multiple items rather than a particular item sold. Parts and raw materials are frequently tracked to particular sets (due east.g., batches or product runs) of goods, then allocated to each particular.

Central Terms

- raw materials: A raw textile is the bones cloth from which a product is manufactured or made.

- labor: Effort expended on a particular task; toil, piece of work.

- overhead: Any cost or expenditure (monetary, fourth dimension, effort or otherwise) incurred in a project or activity, that does not directly contribute to the progress or consequence of the projection or activeness.

Cost of Goods

The toll of appurtenances produced in the concern should include all costs of production. The key components of toll by and large include:

- Parts, raw materials and supplies used,

- Labor, including associated costs such as payroll taxes and benefits, and

- Overhead of the business allocable to production.

Most businesses make more than one of a particular item. Thus, costs are incurred for multiple items rather than a item item sold. Determining how much of each of these components to classify to particular goods requires either tracking the item costs or making some allocations of costs.

Parts and Raw Materials

Parts and raw materials are often tracked to detail sets (e.1000., batches or production runs) of goods, and then allocated to each item.

Labor

Labor costs include direct labor and indirect labor. Direct labor costs are the wages paid to those employees who spend all their fourth dimension working direct on the production existence manufactured. Indirect labor costs are the wages paid to other factory employees involved in production. Costs of payroll taxes and fringe benefits are generally included in labor costs, merely may be treated as overhead costs. Labor costs may be allocated to an item or prepare of items based on timekeeping records.

Overhead Costs

Determining overhead costs often involves making assumptions most what costs should be associated with product activities and what costs should exist associated with other activities. Traditional cost bookkeeping methods endeavour to make these assumptions based on by experience and management judgment as to factual relationships. Activity based costing attempts to allocate costs based on those factors that bulldoze the business organisation to incur the costs.

Accounting cycle: Image of the accounting cycle

Overhead costs are often allocated to sets of produced goods based on the ratio of labor hours or costs or the ratio of materials used for producing the set of goods. Overhead costs may be referred to as factory overhead or factory brunt for those costs incurred at the plant level or overall brunt for those costs incurred at the organization level. Where labor hours are used, a burden rate or overhead cost per hour of labor may be added along with labor costs. Other methods may be used to acquaintance overhead costs with item goods produced. Overhead rates may exist standard rates, in which instance there may be variances, or may be adjusted for each prepare of appurtenances produced.

Variable Production Overheads

Variable production overheads are allocated to units produced based on actual apply of product facilities. Fixed production overheads are often allocated based on normal capacities or expected production. More or fewer goods may exist produced than expected when developing cost assumptions (like brunt rates). These differences in production levels ofttimes result in as well much or too niggling toll being assigned to the goods produced. This also gives rise to variances.

Example

Jane owns a concern that resells machines. At the start of 2009, she has no machines or parts on hand. She buys machines [latex]A[/latex] and [latex]B[/latex] for $10 each, and later buys machines [latex]C[/latex] and [latex]D[/latex] for $12 each. All the machines are the same, just they accept serial numbers. Jane sells machines [latex]A[/latex] and [latex]C[/latex] for $xx each. Her price of goods sold depends on her inventory method. Under specific identification, the cost of appurtenances sold is:

[latex]$10+$12=$22[/latex]

which is the particular costs of machines [latex]A[/latex] and [latex]C[/latex]. If she uses FIFO, her costs are:

[latex]$10+$10=$20[/latex]

If she uses average cost, her costs are:

[latex]\dfrac{$ten+$10+$12+$12}{$4} \cdot $2=$22[/latex]

If she uses LIFO, her costs are:

[latex]$12+$12=$24[/latex]

Thus, her turn a profit for accounting and tax purposes may exist $20, $18, or $16, depending on her inventory method.

Menstruum of Inventory Costs

Accounting techniques are used to manage assumptions of cost flows related to inventory and stock repurchases.

Learning Objectives

Talk over how a company uses LIFO or FIFO to calculate the cost of inventory

Key Takeaways

Key Points

- Accounting techniques are used to manage inventory and fiscal matters – how much money a company has tied upward within inventory of produced goods, raw materials, parts, components, etc. These techniques manage assumptions of cost flows related to inventory and stock repurchases.

- FIFO stands for first-in, showtime-out, meaning that the oldest inventory items are recorded as sold showtime, but practise not necessarily mean that the exact oldest concrete object has been tracked and sold.

- LIFO stands for concluding-in first-out. The most recently produced items are recorded every bit sold first. Since the 1970's, companies shifted towards the use of LIFO, which reduces their income taxes. The International Financial Reporting Standards banned using LIFO, so companies returned to FIFO.

Key Terms

- LIFO: Last-in, beginning-out (accounting).

- FIFO: First in, beginning out (bookkeeping).

- accounting: The development and use of a system for recording and analyzing the financial transactions and fiscal status of a business concern or other organization.

FIFO and LIFO methods are accounting techniques used in managing inventory and fiscal matters involving the amount of money a company has tied upwardly within inventory of produced goods, raw materials, parts, components, or feed stocks. These methods are used to manage assumptions of cost flows related to inventory, stock repurchases (if purchased at dissimilar prices), and various other accounting purposes.

Accounting Cycle: The bookkeeping cycle (flows).

FIFO stands for first-in, first-out, meaning that the oldest inventory items recorded get-go are sold first, simply does not necessarily hateful that the exact oldest physical object has been tracked and sold.

- An instance of how to summate the ending inventory remainder of the period using FIFO — presume the following inventory is on hand and purchased on the following dates:

- Inventory of Product 10 –

- Purchase date: ten/1/12 — 10 units at a cost of USD 5

- Purchase date: 10/five/12 — 5 units at a toll of USD half-dozen

- On 12/30/12, a sale of Product X is fabricated for 11 units

- When the sale is made, it is assumed that the x units purchased on 10/1/12 (the auction eliminates this inventory layer) and 1 unit purchased on 10/5/12 were sold

- The ending inventory balance on 12/31/12, is 4 units at a cost of USD 6

LIFO stands for last-in, outset-out, pregnant that the virtually recently produced items are recorded as sold offset. Since the 1970'south, some U.S. companies shifted towards the use of LIFO, which reduces their income taxes in times of aggrandizement. Still, with International Fiscal Reporting Standards banning the use of LIFO, more companies have gone dorsum to FIFO. LIFO is only used in Japan and the The states.

- An example of how to calculate the catastrophe inventory rest of the catamenia using LIFO — assume the following inventory is on mitt and purchased on the following dates:

- Inventory of Production X –

- Purchase date: 10/one/12 — 10 units at a cost of USD 5

- Purchase engagement: 10/5/12 — v units at a toll of USD 6

- On 12/30/12, a sale of Product Ten is made for xi units

- When the sale is made, it is assumed that the 5 units purchased on x/5/12 (the auction eliminates this inventory layer) and vi units purchased on 10/1/12 were sold

- The ending inventory residual on 12/31/12, is 4 units at a cost of USD v

Differences betwixt Inventory Costing Methods

The deviation between the toll of an inventory calculated under the FIFO and LIFO methods is called the LIFO reserve. This reserve is substantially the corporeality by which an entity's taxable income has been deferred by using the LIFO method.

Differences in Periods of Rising Prices (Aggrandizement)

- FIFO (+) Higher value of inventory (-) Lower cost of goods sold

- LIFO (-) Lower value of inventory (+) Higher cost of goods sold

Differences in Periods of Falling Prices (Deflation)

- FIFO (-) Lower value of inventory (+) Higher toll of goods sold

- LIFO (+) College value on inventory (-) Lower toll on goods sold

Methods of Preparing Cash Period Statements

- The direct method of preparing a greenbacks flow statement results in written report that is easier to understand. It creates a cash flow argument written report using major classes of gross greenbacks receipts and payments.

- The indirect method is almost universally used considering FAS 95 requires a supplementary report similar to the indirect method if a company chooses to use the straight method. It uses net-income as a starting point, makes adjustments for all transactions for non-cash items, then adjusts from all cash-based transactions. An increase in an asset account is subtracted from internet income. An increase in a liability account is added back to internet income. This method converts accrual-footing net income (or loss) into cash flow by using a series of additions and deductions.

Source: https://courses.lumenlearning.com/boundless-accounting/chapter/understanding-inventory/

0 Response to "How Can You Determine if There Are Enough Finished Goods in Inventory to Fulfill a Sales Order?"

Post a Comment